Record German mill production

22 November 2018The German softwood sawmilling industry is likely to achieve record production levels, reports Lars Schmidt, CEO of the German Association of the Sawmilling and Timber Industry (DeSH)

At the beginning of 2018, the German sawmill industry was in a significantly more favourable starting position than in the previous year, because of two main factors.

First, the brisk construction activity due to the absence of the usual weather-related sales slump in construction in the winter half-year, and second, the German machinery and plant engineering sector, which is still very successfully exporting its products internationally and demands a lot of wood packaging and load carriers.

Thus, the German domestic sales market for wood developed very positively. At the same time, the development of exports of sawn timber from 2017 continued.

Storm wood

In the course of the spring, the log wood supply to the sawmills – which was initially hampered by wet weather restricting forest access – improved due to a late cold snap and then also an accumulation of significant amounts of wind thrown wood after several storms. The volume of wind-blown timber varied regionally.

In the following months the volumes caused a significant improvement in the raw material supply situation of the sawmill industry and a noticeable increase in sawn softwood production.

Expectations that prices for sawn softwood would continue to rise due to strong demand for sawn timber were not fulfilled during the course of the year due to high capacity utilisation in the sawmill industry.

The sales situation for waste timber, which has been unsatisfactory for a longer time has worsened because of a lack of regional customers.

The improved raw material supply caused by the storms gave the industry a competitive advantage on the procurement side compared with suppliers from northern Europe (for example, in comparison to Finland).

The improvement in supply was then put into perspective by forestry restrictions on green wood logging in those regions with a lot of wind blown trees. The forestry and sawmill industries took precautions such as wet storage in order to reduce the deterioration in timber quality.

This is important because the product range of German softwood is shifting towards higher quality assortments.

This is done especially with regard to modern timber construction, which requires dimensionally stable and high-quality wood and which increasingly uses strength-graded, refined and glued products. Exemplary construction projects using this type of product can be seen in London.

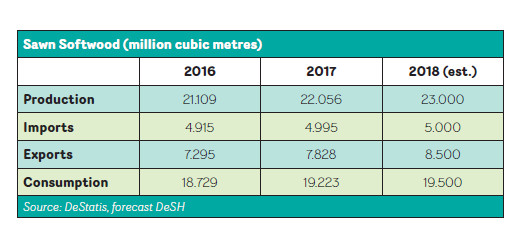

Record sawn softwood output

With 23 million m3 of softwood timber expected to be produced in Germany, a new all-time high is expected for 2018, which is likely to continue in the following year. Because of the long drought this summer, additional wood blow can be expected.

Due to its high degree of afforestation, sustainably managed, predominantly certified forestry and efficient industrial enterprises, it can be assumed that Germany will maintain its leading position in European sawn softwood production.

One-third of the sawn wood (about 8.5 million m3) continues to be exported – an important mainstay for German sawmills for many years - alongside the dominant domestic market.

The main sales areas are the neighbouring countries of the EU (including Britain), the US and North Africa.

Britain does not play an outstanding role as a buyer country for German sawn softwood in terms of volume, nevertheless, exports to the UK in the softwood sector have increased by more than 3% since 2014 to 415,000 m3 of rough and planed timber in 2017.

And in the first half of this year, German exports to the UK exceeded deliveries in the same period of 2017 by more than 16%. In parallel, a trend towards higher quality sawn wood assortments can be seen.

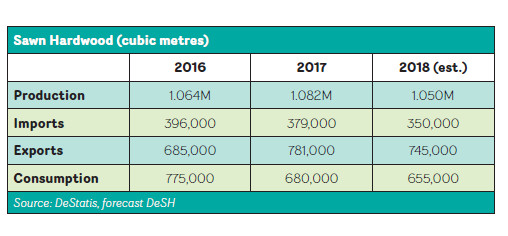

Hardwood sector

Sales in the hardwood sector performed well in the beginning of 2018.

Sales of sawn wood revived due to demand from Asia, especially China, with relatively stable domestic sales.

Demand for German sawn wood from the US fell short of expectations. Domestic production has been moving around the 1 million m3 mark for years (forecast for 2018: 1.05 million m3).

Due to the shift of many sawn hardwood customers to the east, which has been seen for years, the hardwood sawmill industry has inevitably proportionally become more export-oriented than the softwood industry, which supplies the economically powerful domestic construction market.

Therefore about half of the German sawn hardwood production will be exported.

On the supply side, wet winter weather and the relocation of some wood reprocessing capacity into the coniferous forest areas hit by storms caused problems at the beginning of 2018.

In addition, hardwood round timber exports from German forests to Asia increased again in 2017.

Furthermore, the industry is confronted with the ongoing demands of environmental associations and politicians to exclude additional forest areas in the federal territory from forestry use in favour of conservation.

Both factors are leading to a shortage of the raw material used by German hardwood sawmills and are thus hampering sawn wood production and processing in the country.

In the case of oak it is still a “seller’s market” with supply bottlenecks and correspondingly noticeable price increases. The same applies to ash, which is expected to become increasingly scarce due to the continuing decline in ash health.

In principle, however, beech is available in sufficient quantities and the volume that will be exported as sawn wood is increasing from year to year. It now accounts for half of sawn hardwood production.

Britain is at number 11 in the ranks of the most important export destinations for hardwood from German mills, accounting for 20,000m3. The total volume has tended to decline somewhat since 2012 but the UK remains an important market for the German hardwood sawmill industry.

Brexit casts shadow

Unfortunately, the impasse in the Brexit negotiations is also casting its shadow over the timber trade. If no agreement is reached between the UK and the EU, trade barriers threaten to arise between the UK and Germany as a result of customs formalities, including for timber products.

No less worrying is the threat of a trade war between the US and China, which could have an impact on the international flow of goods and thus also has noticeable consequences in Europe. Uncertainty in the markets is to be feared.

Meanwhile, the shortage of skilled workers does not stop at the sawmill industry in Germany and DeSH (German Association of the Sawmilling and Timber Industry ) has been devoting more and more attention to this topic for several years now.

For example, as part of the “it wood be good” campaign for young people, which is aimed specifically at future apprentices, a website with videos and a job exchange was created, and since 2017 a saw simulator has been in use at schools and at training fairs.

For the first time The Sawmill Congress 2018 dedicated a separate slot to the question “What does Generation Y expect from the world of work?”

In addition to lectures, students from all over Germany were also present at the congress in order to make contact with the companies at an early stage.