Increase in Q1 value sales driven by price inflation

24 May 2022The latest figures from the Builders Merchants Building Index (BMBI), published in May, show Q1 2022 was a bumper quarter thanks in part to a record-breaking March, which clocked up the highest ever total sales in the history of the BMBI. However, the increase was again driven by price inflation (+16%) more than volume growth (+1.5%).

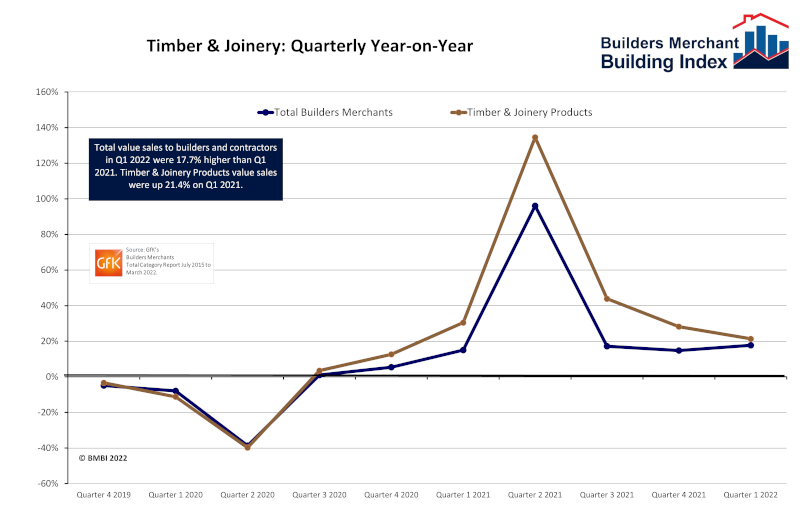

Total value sales to builders and contractors in Q1 2022 were 17.7% higher than Q1 2021, with no difference in trading days. All bar one category sold more. Renewables and water saving (+29.3%) did best, followed by kitchens and bathrooms (+26.3%), which recorded its best-ever quarterly sales, and timber and joinery products (+21.4%).

Comparing Q1 2022 with Q1 2019, a pre-pandemic year, total value sales were 24.7% higher, with no difference in trading days. All categories sold more including landscaping (+51.4%) and timber and joinery products (+40.6%), which did particularly well.

Quarter-on-quarter, sales were up 11.4% in Q1 2022 compared to Q4 2021, helped by three more trading days in the most recent period. All categories sold more including timber and joinery products (+6.9%). Like-for-like sales were 6.1% higher than Q4 2021.

“Having successfully navigated the challenges posed by Brexit and then Covid, the conflict in Ukraine is disrupting supply chains and causing major problems in many different areas of our business,” said Simon Woods, European sales, marketing and logistics director, West Fraser and BMBI’s expert for wood-based panels.

“The first issue is the supply of timber products which are usually sourced solely, or mostly from Russia, Belarus, or Ukraine. Russian birch plywood, for example, is widely used for its looks and strength, characteristics that are difficult to emulate with other materials. As such, timber suppliers have been scrambling to find replacements for it since the invasion began. A specially formulated OSB with a paper coating is one possible alternative being investigated.

“Fibre (wood) is also in short supply. The movement of fibre from Russia and Belarus into Europe has almost completely stopped, causing major issues for some manufacturers. Fibre was already experiencing shortages thanks to an increase in bark beetle infestations. The upshot is that fibre is now more expensive, and it will go to sectors able to pay the higher prices.

“The invasion has also put further pressure on energy resources, so prices are volatile. The scale of the increases is catastrophic to manufacturing businesses who rely heavily on energy (70% of UK electricity is derived from gas) and are unable to absorb the extra outgoings.

“The availability and cost of chemicals such as urea (a base chemical for manufacturers and crop fertilisers), a fifth of which is sourced from Russia, is also causing major disruption.

“Altogether, it’s made for a difficult start to the year, and there may well be more choppy waters ahead for timber, as a fragile supply chain and rising prices will surely take its toll on all those involved in the sector as we move through Q2 and beyond.”

For the latest reports, expert comments and round table debates, visit www.bmbi.co.uk.

The Builders Merchant Building Index (BMBI)

The BMBI is a brand of the BMF. The BMBI report, which is produced and managed by MRA Research, uses GfK’s Builders Merchant Point of Sale Tracking Data which analyses sales out data from over 80% of generalist builders’ merchants’ sales across Great Britain. The full report is on www.bmbi.co.uk.