Some take the heat better in tough fire door market

5 September 2009Volume timber fire door manufacturers are being hit hardest by the recession, while smaller companies are benefiting from flexibility and long-term relationships

Summary

• The proportion of FD60 fire doors has risen this quarter.

• There is mounting concern over contractors cutting corners.

• The number of fire doors sold this quarter is down by more than half on the same period in 2008.

The latest fire door survey carried out by Rigby Research on behalf of the BWF-CERTIFIRE Fire Door and Doorset Scheme reveals three distinct trends in the market.

“The companies sampled vary each time, which means the sales numbers don’t give a like-for-like comparison between surveys,” said BWF chief executive Richard Lambert. “What you do get is an indication of trends. Three jump out at me this time round.

“First, while everyone is finding the market tough, the volume manufacturers are finding it toughest. The results show a shift to the medium-sized manufacturers, who have been able to adjust more quickly, and are capitalising on specialisms and relationships built up over the years.

“The shift towards public sector non-housing work is also indicated in the increase in the proportion of FD60s sold this quarter, which is one of the largest since the survey began. It may also reflect the fall-off in housing, and particularly apartment construction, which had driven growth in the fire door market.

False economy

“The third trend is the continuing growth in the number of doors sold with unglazed apertures, suggesting an increase in the number of doors being glazed on site. It’s a false economy. If you’re not certificated to process a door, then the liability for its performance falls on you.

“We’ve had a huge response from facilities managers who’ve seen the BWF-CERTIFIRE Scheme DVD and are contacting us with their concerns about the quality of the fire doors installed in their premises. FM teams tell of having to sort out the problems left behind by contractors who cut corners as they have little understanding of how fire doors work or why they need compatible components.”

This quarter’s report is based on interviewing 45 joinery companies in July 2009, sampled by company size (in volume and number of staff) and region to ensure a balanced spread.

The sample is made up of joinery companies carrying out further work on manufactured timber fire-rated doors without affecting the performance, for example, fitting vision panels or making frames to suit. It includes companies certificated for these processes by the BWF-CERTIFIRE Fire Door & Doorset Scheme, companies certificated by other certification schemes, and companies whose alterations to fire doors are not covered by any certification scheme. The sample does not include prime fire door manufacturers. The charts show joinery companies’ volume sales of timber fire doors and sales by door type, rating and customer base.

Sales figures

Just over 16,900 timber fire-rated doors were sold in April to June 2009 by the companies interviewed. This compares with around 43,500 between January and March 2009 – and 44,400 in April to June last year. As the sample of companies is different each quarter, the volumes will vary depending on the mix of firms interviewed. However, the number of firms in each size band is always comparable. The table shows the percentage of total volume sales by company size and the total number of timber fire-rated doors sold each quarter.

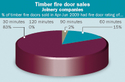

The survey shows that 44% of timber fire doors were bought in by joinery companies as completed fire doors and 56% as door blanks. Timber doors with a 30-minute fire resistance continue to account for the majority of all timber fire door sales (83%) and none were sold with 120-minute resistance.

Fifty-eight per cent of timber fire doors are sold with a filled aperture, which includes vision panels, air vents and letter plates. This proportion increased considerably in the previous quarter and has grown further in Q2. Thirty-one per cent are sold with no aperture and 11% are sold with an unfilled aperture and this segment has been creeping upwards over the past 18 months.

Prices

Most timber fire doors are sold as door leafs (46%) or doorsets (49%) and only a small proportion are sold as door kits (5%). The average price of a door leaf was £130, a doorset was £279, and a door kit £158. In 2008 the surveys showed the average price of a door leaf falling, but this has increased in the last two quarters.

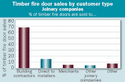

By customer, joinery companies mainly sell to building contractors – with over two-thirds of their sales going to this group. The remaining sales go mainly to installers, with small numbers to other joinery businesses, merchants or other companies.

Forty-one of the joinery companies interviewed this quarter (91%) reported selling timber fire-rated frames. From this sample over 9,600 timber fire-rated frames were sold in April to June 2009, a significant drop from previous quarters. Of those, 79% were manufactured in-house and 21% were bought in.