No Customs Union will create “timber tax bombshell”, says TTF

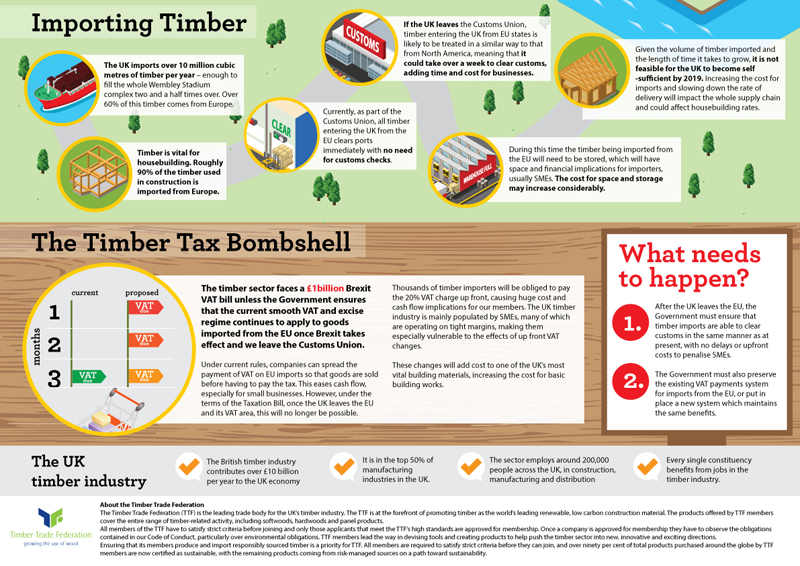

8 May 2018The UK timber industry faces a potential “billion pound Brexit bill” if the UK leaves the EU Customs Union, the Timber Trade Federation (TTF) has said.

“Some 90% of timber used in construction is imported from Europe, which British timber supplies are insufficient to replace,” said TTF managing director David Hopkins.

“Under the proposed Taxation Bill, once the UK leaves the EU and its VAT area, VAT on EU imports will have to be paid upfront. This will cause considerable problems for the SMEs that make up the majority of our sector.”

Builders merchants and their customers relied on just-in-time deliveries of timber and currently timber from Europe – which accounts for 60% of the UK’s consumption – clears ports immediately, without the need for customs checks.

The TTF has launched an infographic to explain what it calls “The timber tax bombshell”.

Problems for all construction supply chains include potential delays, and the costs of storing timber at ports while it clears customers and administering customs checks and documentation.

The TTF is asking the government to ensure timber imports clear customs in the same way, with no upfront costs, or impact on the UK’s housing supply chains.

“The government must also preserve the existing VAT payments system for imports from the EU, or put in place a new system that maintains the same benefits,” said Mr Hopkins.

The timber prices paid by small builders have already risen by 8% in the past 12 months, according to the Federation of Master Builders. The TTF says this is mainly a result of pound’s depreciation since the EU referendum and competitive global markets for construction timber.