The home improvement boom seen through the pandemic is over, the economy may be stuttering. However, mouldings suppliers say they’re adapting to market conditions, developing new product lines, and exploring new marketing and sales channels, notably online. There’s confidence economic conditions will improve through 2024, with predictions construction will see a post-election bounce, and manufacturers are expressing faith in the future with investment in productivity and range development.

SAM sales director Gerard Wilson acknowledged that current economic conditions have put the company on its mettle. “Among customers, the strategic element has taken a back seat as they steer through choppy waters,” he said. “In the light of economic and general market conditions there has been caution around spending generally and stock levels. In the construction sector, commercial and contract projects have been delayed and house buyers are waiting to see what they can afford. With interest rates predicted to decrease, why buy now rather than six to eight months’ time?”

The RMI sector, he added, has not been great, but nor has it been a disaster and, despite the economic picture, there’s no sign of customers opting for lower price points.

Part of the company’s strategy to drive sales has been to increase customer options.

“We’ve retained our presence in the traditional market but expanded the range massively to give merchants a wider range of profiles to offer end users,” said Mr Wilson.

SAM has also introduced the option of smaller pack sizes.

“These give merchants, whose space is at a premium, a wider selection with less risk,” said Mr Wilson. “Offering smaller packs means they can provide more choice without adding stock value.”

He also raised the continuing growth of e-commerce driving consumer demand for more moulding options.

“Following Covid, people are more comfortable shopping online,” said Mr Wilson. “They suddenly understood the world of choice is huge – you don’t just accept what you see in front of you. They want something different and know that, if you dig deep enough online, you’ll find it.”

David Johnson, general manager at Dresser Mouldings, said the company had been impacted by the cost-of-living crisis.

“There was a period of consumer trepidation, belt tightening and putting off spending until market confidence returned, but it looks to be improving, with people having some disposable income,” he said.

Now, he added, Dresser is seeing an increase in enquiries coming from bar fitting and shopfitting sectors and in specification for other refurbishment projects.

“The DIY market has also remained steady since a decline from the Covid home improvement boom,” said Mr Johnson, adding that Dresser too was seeing the impact of the shift to online purchasing. “We’re finding online ordering growing year-on-year, as it becomes the preferred method to purchase direct, so we’re looking of ways to improve the customer experience in this market.”

Dresser has also benefited from becoming part of James Latham. “Our integration into the group has helped drive sales through having a nationwide distribution network. It’s created new opportunities to sell and add value to our timber, panel, and solid surface offering.”

Like SAM, Dresser has not seen customers migrating to lower price points.

“There aren’t cheaper comparable products to our product offering able to meet that requirement in renovation for the Victorian/ period aesthetic,” said Mr Johnson. “It’s difficult for bar and shopfitting sectors too to locate the period-style products customers specify and, as we also have the ability to produce bespoke mouldings, we can be sure to be on spec as required.”

Cheshire Mouldings reports 2023 as a fair year, despite the home improvement surge working its way out of the market. “Of course, we’d all be riding high from the Covid years boom, and 2023 was the first year since 2020 when we didn’t get a spur from it, so it wasn’t as strong as the previous two years, but sales were still robust,” said national sales manager Jacquie Capper.

Moulding sales are still on the up with the growing trend to panel walls in the home. The consumer trend in a slower property market is to ‘improve not move’.

“In the current climate people may not be going for the bigger ticket items, like a new staircase for instance. But with our mouldings and panel kits, for a few hundred pounds they can give a room a total makeover. They can install small section decorative mouldings or pine PSE/MDF strips, which we supply raw, paint it whatever colour they want, and they’ve got a whole new look. Similarly with our Acoustic panels, which come in four colours, with grey the latest addition.”

Mouldings and kits are selling via merchants, DIY, and other retail. The company, which now boasts a turnover of around £40m, has also built a high-profile marketing campaign for them, notably on social media, with some of its customers now selling Cheshire’s products online.

“Last year we invested in online influencer campaigns, using a company which specialises in developing them and matches influencer to product,” said Ms Capper. “They’ve been a big success, highlighting not just the look of the mouldings and panels but also their ease of installation.”

Cheshire Mouldings, which highlights its ‘made-in-the-UK’ pedigree, has also focused on raising its brand profile generally.

“We’re now seeing consumers asking our customer-base specifically for Cheshire Mouldings,” said Ms Capper. “It shows they’re not just looking for mouldings, they’re looking for our mouldings.”

The company is also using QR codes on posters and fitting instructions for customers to access further product information. “It’s useful for our marketing to know what customers are interested in and can help inform our product development,” said Ms Capper.

Cheshire says its wider mouldings sales are also now showing good growth, partly due to “riding high on the growing fashion for wall panelling”.

The company has a limited MDF selection, and supplies oak product, but the bulk of its mouldings are in pine, which can be left natural, painted, or stained.

“Our biggest selling profile is double astragal,” said Ms Capper. “We’re selling 7,000 to 8,000 pieces a week.”

At Dresser, period decorative mouldings remain the top performers.

“We’ve refined our offer in the last three years, trimming the slower movers, which have usually been the contemporary mouldings from the range,” said Mr Johnson. “Trends change, so we have to remain versatile.”

Dresser, which has an ex-stock range of 70-plus, reports that MDF remains popular in the commercial sector, due to its moisture resistance, stability, and uniformity and the MDF range is more contemporary generally. “[But] Where our clients require quality and character, solid timber mouldings are usually the choice,” said Mr Johnson. “Redwood and tulipwood remain popular for housing developers and homeowners, the majority of which is natural to white prime on site.

We also sell natural in materials such as American white oak.”

SAM continues to see a market shift to “white-primed MDF in the racks against traditional timber”.

“Our drive has been improving the choice of products. New profiles and a wider range available ex-stock,” said Mr Wilson.

The company has also invested £1m on the development of a new primed finish. It’s billed on the SAM website as resulting in a “brighter, whiter product and smoother finish to make it easier to achieve a superior final finish”.

Other news from SAM includes a £7m investment programme, which includes construction of a 45,000ft2 new warehouse in Antrim.

“We’ve also got a new production line and other new technology coming onstream,” said Mr Wilson.

Capital spending has also taken place at Cheshire Mouldings, including a £1.2m investment in a 100m/min System TM fingerjointing line and associated equipment that will, says Ms Capper, boost productivity and improve grading and yield.

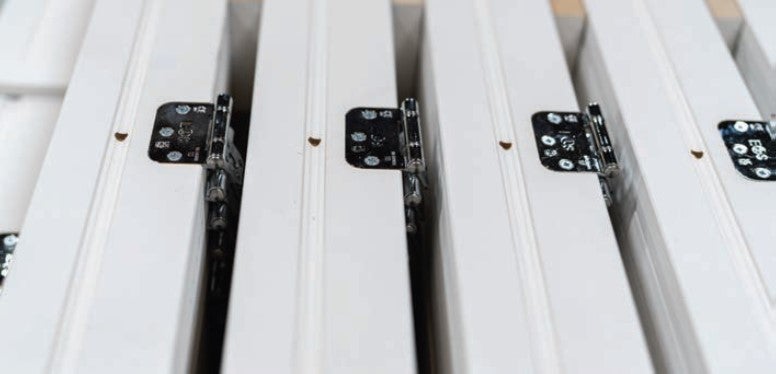

Ongoing investment at Dresser has seen installation of an M-Power MRA 350/400

radial arm cross-cut saw, a Houfek Twingo twin head brushing machine and a Fast & Fluid paint dispenser. Following a computer upgrade, 2024 will also see the introduction of a new production planning system.

All these companies say they’re now taking an upbeat outlook, expecting market strengthening as the year progresses.

“We’re looking to develop our merchant offering and promote our products to trade counters nationwide,” said Mr Johnson. “More work on specification would also stimulate another route to market.”

“There are always challenges – most recently it’s been strikes in the Finnish timber sector and the Suez situation,” said Ms Capper. “But there are positive signs and we’re continuing to strive to develop our range. Whichever party wins the election, they’ll have to build more housing and consumer confidence will grow as interest rates decrease.”

SAM also has “new developments” in the pipeline.

“2024 is going to see exciting new developments in our evolution and growth,” said Mr Wilson.