Downbeat economic forecasts shared at TDUK markets conference in London

9 November 2023UK and international timber traders gathered in strong numbers for Timber Development UK’s Global Market Conference in London on Wednesday at a time of difficult market dynamics.

A noticeably downbeat market sentiment was palpable at the event held in Carpenters Hall, London due to low timber product demand and prices, coupled with a number of other strong economic headwinds. Sawmillers from Sweden, Finland, Ireland and Scotland shared their thoughts on current and future market dynamics.

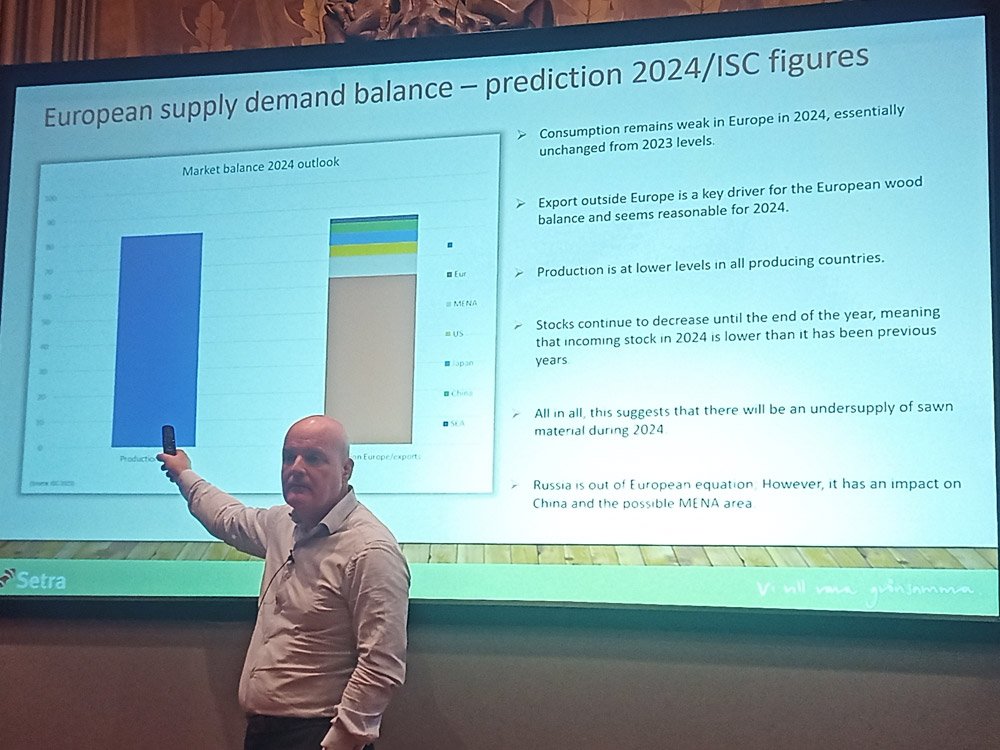

Speaker Olle Berg, EVP market and business development of Setra Group, said from May 2023 onwards it has been a case of price decreases and reduced production.

But he suggested prices were likely now at their bottom and may increase in the coming months due to various factors – something he acknowledged would cause tension in the low demand environment. Wood consumption, he said, would remain weak in 2024 – essentially unchanged from 2023.

“The single biggest problem for wood consumption is interest rates,” he said.

Mr Berg said in the past, downturns had followed a consistent pattern, but he said there were some different features of the current market situation. This shift included the fact that sawmills had not kept producing as they did in the past downturns, but had reduced shift levels.

Mr Berg shared European and global timber statistics, showing that Spain was the only country in Europe recording growth (+1%) in timber import levels in January-June 2023. The UK registered a 5% decrease, Mr Berg added, actually outperforming most other countries in Europe.

In all, European timber imports / exports to and from Europe were down 21% during the period – equivalent to 3.1 million m3, with Russia & Belarus accounting for 2.1 million m3 of that.

Major European sawn timber producing countries Germany, Sweden and Finland are all producing less, with European production decreasing by 14.6 million m3 between 2021 and 2024. Log costs are high and availability “critical” for producers. Swedish sawmillers are reducing shifts in Q4 because of log shortages.

“This situation will stay this way over the coming years and over a longer period,” commented Mr Berg.

European demand, he added, would exceed supply next year as lower production continued. The trajectory of the US, China and MENA markets would be important for European sawmills to maintain reasonable sawmill production levels in 2024.

Mr Berg predicted continuing challenging market conditions, with inflation and interest rates staying high in 2024.

Meanwhile, the TDUK National Softwood Division forecasts were shared by Nick Boulton, TDUK, head of technical and trade policy.

The 2022 value of UK wood and panel imports was £5.9bn. UK production was 6.6million m3 and imports were 11.2 million m3, giving a total of 17.8 million m3.

Softwood accounted for 3.108 million m3 of the UK’s wood product output, with hardwood having just 37,000m3. Particleboard and OSB accounted for around 2.6million m3 and MDF/HDF around 856,000m3. UK softwood consumption was down 21% to 8.625million m3 in 2022, with a further 7% down this year before seeing a 1% improvement in 2024.

Softwood imports were down 25% in 2022 to 5,677million m3 and are expected to reduce by 5% in 2023 to 5.385 million m3, before making a 2% rebound in 2024 to 5.474 million m3.

The Forest Research UK forecasts shared by Mr Boulton shows a UK sawn softwood production dip in 2023 to 2.860 million m3 (down from 3.110 million m3 in 2022). The figure is expected to remain flat in 2024.

(More reports from the conference to follow)