Recession eases in construction

3 October 2009There are grounds for optimism in construction, but consumers remain wary

Consumers remain cautious about prospects for the UK economy, but are less pessimistic than this time last year. That at least is the conclusion to be drawn from the August poll by GfK NOP, which is attributed to recent reports of improvements in the housing market.

But consumers remain uncertain about the wisdom of spending on major purchases. Instead they are increasingly looking at saving as the appropriate response to the present economic climate, which has unemployment rising to 7.9% of the working population and wages barely keeping pace with inflation.

Reflecting this mood among consumers, growth in retail sales of furniture stalled in August, with volumes down 5.7% on the month, and the yearly rate estimated by National Statistics at –1.1%. The value of sales fell by 4.4% in August, but this translated into annual growth of 1.2% – up from 0.1% in July. UK demand for imported furniture dropped by 19% between the first six months of 2009 and the same period last year. Office and shop furniture, and kitchen furniture, contracted most, with year-on-year falls of 31% and 29% respectively. British furniture makers fared rather worse, recording a 22% drop in exports overall, with kitchen furniture sales down 39%, and chair and seat demand 27% lower than in the first half of 2008.

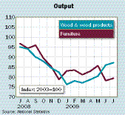

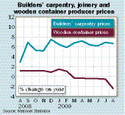

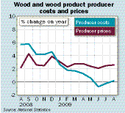

Pressure is mounting on factory gate prices, with a fall of 0.4% in the year to August, compared with a 1.3% drop in the year to July. Input costs are rising more quickly, up by 2.2% in August. In the second quarter of 2009 the average cost of corporate services fell by an annual 0.4%, after rising by 0.8% the previous quarter, according to government statistics. Within the corporate services total, the year-on-year cost of road freight transport fell by 0.2%, while sea and coastal water freight dropped 15.7%, and freight forwarding costs were down 6.5%. Meanwhile there are some grounds for optimism in the housing market where two indices show that property prices rose in August for the second month in a row. Further, the building industry saw a slowdown in the decline of output in the second quarter. The total volume of output, adjusted for seasonal variations, fell by just 0.5%, compared with an 8% drop in the first quarter. Total new work rose 1% on the quarter – reflecting a sharp increase in infrastructure projects – while repair and maintenance fell by 2%. New private-sector housing output fell 28% annually and was 3% lower on the quarter; housing repair and maintenance was up 1% on the quarter but down 1% annually.

Signs that the squeeze on construction is easing are provided by the Purchasing Managers’ Index (PMI), which shows that, although activity continued to contract in August, it was at the slowest rate for 18 months. There was additional good news from the PMI, with the housing sector showing a marked easing on the pace of contraction recorded in July.

Further, the decline in new orders has slowed sharply over that reported at the beginning of the year, and companies have sustained their optimism about future levels of business activity overall. But purchasing activity continued to decline in August, as firms preferred to use existing stocks rather than buy new materials.

Looking at likely future demand, official estimates indicate that the volume of orders for new private housing placed with contractors in the three months to July was down 7% on the previous three months and 35% lower than at the same time last year. Orders for new commercial projects fell 11% compared with the previous three months and were 45% lower than a year earlier. Analysts at Oxford Economics now predict that after some further short-term weakness, construction output will rise gradually through 2010, followed by more robust growth in 2011.