Agents of change

17 May 2014Price & Pierce has evolved its business and is forging new markets for its supplier partners, including panel producers Unilin and CMPC Plywood. Sally Spencer reports.

For many years there has been a school of thought that the del credere timber agent is a dying breed, falling victim to the changing dynamics of global trade.

And yet some timber agents continue to go forth and prosper, representing proactive suppliers and supplying a growing customer base.

One of this number is Woking and Hullbased Price & Pierce Forest Products Ltd, a company that has continued to thrive because of its willingness to adapt and diversify.

The original agency was established in the 1860s but its current incarnation, the result of a management buyout, dates back to 2000. It maintains its agency role and is also now a major distributor of timber and panel products and holds substantial stocks, enabling it to supply its customers on a just-in-time basis.

Managing director Stephen Pitt is philosophical about the change of business model. "Only about 25% of our revenue might be driven by agency business and that has been diminishing over the last few years," he said. "But we have diversified to become a distributor and stockist and as that now accounts for the majority of our business it's not so concerning that there sometimes appears to be less of a future in being a timber agent.

"At the time of the management buyout we would never have imagined what we are doing now but I think we've succeeded because we didn't have any preconceived ideas about where we needed to be and we've reacted to whatever has been put in front of us."

Ten years ago, he said, by way of example, Price & Pierce was selling full cargoes of timber products to Travis Perkins on a CIF basis through Shoreham. Now it's fine-tuned and developed its business and loads a vessel with mixed products in Ventspils in Latvia every month and ships it to Poole where it is discharged.

"We hold 7,000-10,000m³ of stock there at any one time and deliver to around 350 branches of Travis Perkins all over the southwest of England," said Mr Pitt. "We turn over 3,000-4,000m³ per month from there and keep our stocks high because we're offering a large range of products.

"We have a long-standing relationship with one of the most significant shippers in Latvia and bring in everything from treated and untreated carcassing, decking, slating battens, CLS, sleepers, pegs - a whole shopping list of products from which we can make up a load - and send it out to the customer," he added.

"We've had to respond to what our customers want in order to sustain and develop our relationships with them."

All of Price & Pierce's Travis Perkins business goes through Poole while other products - notably Chilean plywood and Latvian decking - go into Tilbury or Ipswich. Customers who can handle containers pick it up from Tilbury but for others who want it break bulk FOM, the containers are taken off the vessel at Tilbury and transported by road to Ipswich for destuffing and storage.

Chilean plywood

Amalgamation and consolidation at both ends of the supply chain may have reshaped the customer base but one constant for Price & Pierce - and a key part of its remaining agency business - has been its enduring relationship with Chilean plywood producer CMPC, which it has represented for around 26 years.

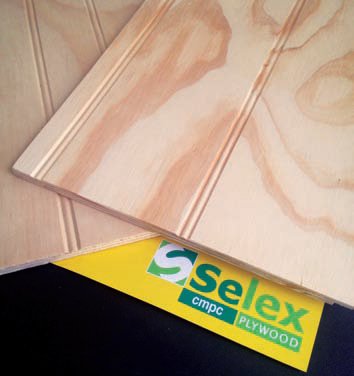

CMPC's Selex plywood plant has an annual capacity of 500,000m³, making it the largest single plywood plant in the world. Its 100% radiata pine structural grade Selex II/III is available in a range of thicknesses, from 6.5- 25mm and is suitable for construction as well as a variety of other uses such as flooring, decorative sheathing, furniture and cabinetry.

What Price & Pierce adds to the mix, said Mr Pitt, is "a phenomenal insurance policy that covers a whole range of issues".

"We guarantee the finance but the most important thing we provide CMPC with is the flexibility to sell their products within what is now quite a complicated market structure in the UK."

And, as the boundaries between trade and retail continue to blur, this has paid dividends. Thanks to Price & Pierce's connections with B&Q's purchasing and merchandising team, the DIY giant is now stocking CMPC's Selex plywood.

"Manufacturers love the idea of retail so when we mentioned the possibility of selling to B&Q they were immediately very positive," said Mr Pitt. "It's a real game changer."

That's not to say, however, that merchants are being cut out of the loop and more production will come on stream. "As with the whole of South America, CMPC is on a march and its intention is to double its Selex plywood capacity to a million m³ by 2020," said Mr Pitt.

He cautions, however, against UK customers thinking the company is going to stack it high, sell it cheap. "Some people in the UK trade think it all begins and ends here - it doesn't. The UK currently represents less than 5% of CMPC's total worldwide sales so if UK customers don't pay the price it's not a problem to CMPC, they'll just go elsewhere."

Having said that, while global producers may have taken their eyes off the UK market during the recession, the upturn in construction and the consequent squeeze on supply from domestic manufacturers has caused some refocusing.

UK market ambitions

Another of Price & Pierce's clients, with similar global reach to CMPC, is ultra keen to penetrate the UK market. That client is the Belgian giant Unilin, a superpower in terms of chipboard and MDF production.

A sea change for Price & Pierce came in 2011 when, as part of its programme of diversification, it acquired the Eric Matthews panels distribution business. In doing so it took on the representation of the Belgian Spano Group which, at the time, produced around 300,000m³ of MDF and 600,000m³ of chipboard.

"We learned the [distribution] business and broadened the customer base and then, in 2013, Unilin bought Spano," said Mr Pitt.

"Fortunately, Unilin liked what we'd done for Spano and asked us to carry on representing the combined group.

"Unilin didn't buy the Spano MDF plant but its own MDF production is 600,000m³ per year and its own chipboard production is in excess of one million m³. Suddenly we were representing a massive combined chipboard and MDF group who were saying that they could double or triple their sales into the UK. As demand increases here, and there is more of a struggle for domestic producers to supply that demand, they see the UK as a big market for them."

Through Price & Pierce, Unilin is now really pushing into the UK and, said Mr Pitt, is taking a long-term view of the market here. "They want to be a serious player in the market across all their products," he said.

One product in particular stands out, however, and that is Spano's P5 chipboard, which is marketed under the brand name Durélis and flagged up as an alternative to OSB3 for structural flooring, wall and roof construction.

"It's a top quality product with a very smooth, hard surface that differentiates it from any other chipboard," said Mr Pitt. The manufacturer describes the surface as "Topfinish" although there is actually no finishing process involved.

Spano uses a paper press, which generates more heat at the start of the production process than a conventional chipboard press, resulting in a smooth, almost MDF-like finish that requires no sanding.

The 'finish' makes Durélis airtight, moisture resistant and easy to clean. "It's very compact and smooth and can even be substituted for plywood in concrete formwork," said Mr Pitt.

The board is produced with a four-sided technical tongue and groove and changes to this profile are an indication of Unilin's commitment to the UK market.

"The existing product didn't have a UK T&G profile, which could have been a barrier to merchants and distributors who wanted to stock chipboard from different producers," said Mr Pitt. "I advised Unilin that they could go so far in the UK but to take the big leap they would need to invest in new tooling equipment and change their T&G profile. That's what they did and the product was ready for the UK market in March.

Routes to market

Price & Pierce is targeting several different routes to market for Durélis. "We're targeting distributors, merchants and end users, such as the caravan industry," said Mr Pitt, adding that the latter sector in particular was already a significant customer.

But again, the exciting breakthrough is with B&Q.

"You have to credit B&Q for wanting to differentiate themselves," said Mr Pitt. "We've already seen that with them going for Chilean plywood. And they've picked Durélis up very quickly because it's a premium product that they can sell at a competitive price. It started being delivered from the plant into B&Q stores in March."

There is a growing band of followers for the Unilin products and Price & Pierce is going to work hard to push them further into the UK market.

"Our aspirations for the T&G are to achieve 50,000m³ into the UK this year," said Mr Pitt. "In the context of the overall market that's not all that significant but we could be at much more next year. And Spano and Unilin's combined production of T&G is around 350,000m³ per year, so the capacity - and the potential - is there."

Unilin/Spano products

The Unilin/Spano products marketed by Price & Pierce include: Durélis; Durélis flooring (P1, P2, P3 and P5 chipboard), fire retardant board including BS Class 0; fire retardant and moisture resistant combi boards; shuttering and hoarding boards; ecological structural Naturspan boards, including flooring; and SpanO-SB5, 6 and 7 boards.

Unilin/Spano's products also include the SpanoTech range of boards suitable for sustainable building and passive housing solutions, such as Durélis Vapourblock; fire resistant Hidroflam Vapourblock; and Naturspan Vapourblock.

Unilin also produces a full range of UniMDF products.

Price & Pierce product portfolio

Price & Pierce also represents Kurekss in Latvia and the Siljan Sawmill Group, Norrskog Wood Products and Ostanasagen in Sweden, along with other mills in Sweden, Finland and Germany.

The company also markets the Delospan range of veneered boards and flooring.

The profile of Durélis’s four-sided technical tongue and groove has been altered to suit the UK market

The profile of Durélis’s four-sided technical tongue and groove has been altered to suit the UK market

Durélis is extremely versatile,making it a suitablematerial forwall construction aswell as for flooring

Durélis is extremely versatile,making it a suitablematerial forwall construction aswell as for flooring