Joined-up thinking

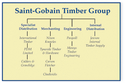

4 April 2009Saint-Gobain’s Timber Group covers all the bases from procurement and import, to processing and distribution, including Jewson internal timber supply. Mike Jeffree reports on the development of this new power in the UK wood sector

Summary

•Saint-Gobain Building Distribution created its Timber Group in 2007.

• It comprises 10 Saint-Gobain businesses.

• Saint-Gobain group member Jewson is one of the London 2012 Olympics timber supply panel.

• The Group launched a Timber Trading Academy last year.

• 193 Jewson branches have environmental chain of custody certification for timber.

The launch of its Timber Group by Saint-Gobain Building Distribution (SGBD) in 2007 was a major statement of intent.

The new organisation was created to co-ordinate SGBD’s operations in timber importing, machining, manufacturing, engineering and distribution. Its core role is to supply and develop the timber business at Saint-Gobain’s builders merchant arm Jewson, but its specialist distribution and processing companies also sell widely to other customers. It has established its own Timber Trading Academy and driven forward an environmental programme which has so far seen timber operations at 193 Jewson branches gain chain of custody certification. The Group co-ordinated Jewson’s successful application to be on the London 2012 Olympics timber supply panel and is also focusing on opportunities in timber frame and offsite construction.

Overall, said Timber Group managing director David Gledhill, it has given SGBD’s wood business “clarity and cohesion” and it’s helping restore Jewson’s reputation as a timber specialist.

Mike Jeffree sat down with Mr Gledhill, Timber Group procurement director Mark Bowers and SGBD sustainability and quality director Steve Millward to discuss the Group’s background and ambitions for the future.

Mike Jeffree: When and why did the concept for the Timber Group emerge?

David Gledhill: It really started in 2006 – it was just the moment in time. We saw timber and wood products once more becoming products of choice – and for all the obvious reasons: the environmental and sustainability arguments, growing awareness of their potential in offsite construction and advances in timber engineering and engineered timber. That was the driver for us to analyse our proposition. We concluded that, as far as Jewson customers were concerned, we were increasingly seen as a generalist, not the specialist with expertise in wood we had been in the past.

Steve Millward: Jewson had an illustrious tradition in timber. It started in 1836 as a timber merchant and for most of its history this remained its core business. And, of course, companies acquired by Saint-Gobain included other famous timber names like Calders & Grandidge and International Timber. But by the 2000s, while we still had these individual timber operations, as a business overall we risked forgetting this heritage. We needed to reinvent our timber culture and rediscover our focus.

DG: We were also seeing more timber selling through builders merchants generally. Many lacked specialist knowledge and, to an extent, that was resulting in the market dumbing down and, instead of realising its growing potential, reinforcing perceptions of timber as a commodity. We wanted Jewson to be seen as the builders merchant doing timber seriously.

SM: It was about taking timber back to where it belonged, raising perceptions and making it more profitable.

Mark Bowers: Why we also felt we could make this work was that, unlike competitors, we’d retained our timber importing, internal distribution and planing mills. At one point, it might have been easy to let that go and become simply a distributor and merchant, but it now gives us a solid foundation in terms of control over the supply chain and quality and a powerful differentiation in the market.

MJ: So how has the Timber Group influenced the SGBD and Jewson timber culture?

DG: The aim has been to re-engage people with timber across the whole business and to leverage what other Timber Group companies are doing within the Jewson market area. We got the Jewson marketing team to focus on timber and wood products and empowered its branch staff to take responsibility and develop their own timber business. We’re also developing a Timber Group identity. We want employees to identify with their individual companies, like International or Pasquill, but also feel they belong to a bigger operation. As part of this we’ve held two timber conferences where employees talked timber and listened to experts on everything from grading to health and safety.

MJ: Has training helped strengthen your timber focus?

DG: It’s been vital. Our timber knowledge was becoming diluted, as I feel it has across the market. We wanted to reverse that and unashamedly make more of our generalists into timber people. That’s why last year we launched the Timber Trading Academy, which has been a major success. It runs a 12-month course and, even though it’s voluntary, it’s now over-subscribed. This year we have 80 people on it, mostly from Jewson.

MJ: Has the way the Timber Group emphasises what a big timber player you are given you more clout with suppliers?

MB: Our ability to bundle purchases in a central pot inevitably gives us a commercial benefit. But it’s not all about squeezing suppliers on price. We’re looking to build the right long-term relationships. We can buy opportunistically from time to time, but we’re too big to be spot buyers, constantly shifting suppliers. If timber grows in popularity worldwide as we expect it will, and demand exceeds supply, such relationships will be more important than ever.

MJ: How has the Timber Group shaped the environmental policy of its various businesses?

DG: Environmental issues and certification were also among the triggers for pulling the Group together. They’re becoming ever more important and we needed consistency and clarity across the company. As a result, they’re key topics at the Timber Trading Academy.

SM: At the same time we’re not just imposing environmental policy from the top down. The best way to embed these issues is to get everyone to engage and take responsibility, not think “this is a green issue, better call in the Saint-Gobain environment man”. So with chain of custody certification at Jewson, for instance, it’s the branches coming to us saying they want it.

MJ: What about the procurement and importing businesses?

MB: We started the ball rolling on certification in 2004, but our policy continues to evolve. If suppliers came to us five years ago saying we’re not certified and don’t plan to be, we might have entertained the prospect. But not any more. Today we expect them to be certified sustainable or moving towards it. In 2007 about 69% of our total timber products purchase was certified legal and sustainable. Once 2008 figures are confirmed, we expect a rise to around 75% and our next target is 85% certified legal and sustainable by 2012.

DG: We’re also a member of the WWF Forest Trade Network, which entails the WWF auditing our environmental procedures and entitles us to use the Panda logo, something we’re justifiably proud of.

MJ: And how far could certification at Jewson go?

SM: If all 500 branches come forward with a justification for having chain of custody, they’ll get it. Currently 193 have it and more are applying all the time.

MJ: Did being part of the Timber Group help in winning a place on the London Olympics timber supply panel?

SM: Undoubtedly! The Olympic Delivery Authority (ODA) insists that every piece of timber used in Games projects is guaranteed certified and we could present them with a clear, single chain of custody from procurement to delivery. Other companies had to involve supply partners. We had a simpler, more transparent solution which made our presentation much better!

MJ: And when will Olympics timber business get going?

DG: As there are no major all-timber Games buildings, we expect the bulk to come through at third or fourth fix. But we’re already geared up. We’ve dedicated one Castle branch and three Jewson outlets nearest to the Olympics site to handle the business, with Jewson’s regional sales office in Leytonstone co-ordinating everything.

MJ: A big attraction at the Ecobuild show in March was LandARK, the prefabricated timber-framed ecohome from ZEDFactory architects, with the wood supplied by International Timber, processing by Calders & Grandidge, frame prefabrication at Pasquill, renewables from the Jewson Greenworks brand and Jewson ultimately marketing the finished building. Does this project signal your plans to get more involved in timber engineering and the offsite building sector?

DG: It’s early days for LandARK, but we’re already building up our timber engineering activities and Pasquill’s SmartRoof product is effectively a prefabricated room in the roof pod. It’s a market with big potential, but how we develop, as an offsite components and systems manufacturer, or timber supplier to other manufacturers remains to be seen. It will probably be a mix of both.

MJ: So is the Timber Group helping SGBD sell more wood?

DG: Obviously, current market conditions have impacted on all aspects of SGBD’s business, including timber. But it is becoming a bigger part of the mix at Jewson, currently accounting for circa 25% of sales. It’s also made us a more timber aware business overall. At the last annual Jewson conference, where suppliers present their products to our staff, the timber area easily drew the biggest crowds.

MB: And interestingly Saint-Gobain France has been looking at the UK Timber Group, perhaps with a view to doing something similar themselves.